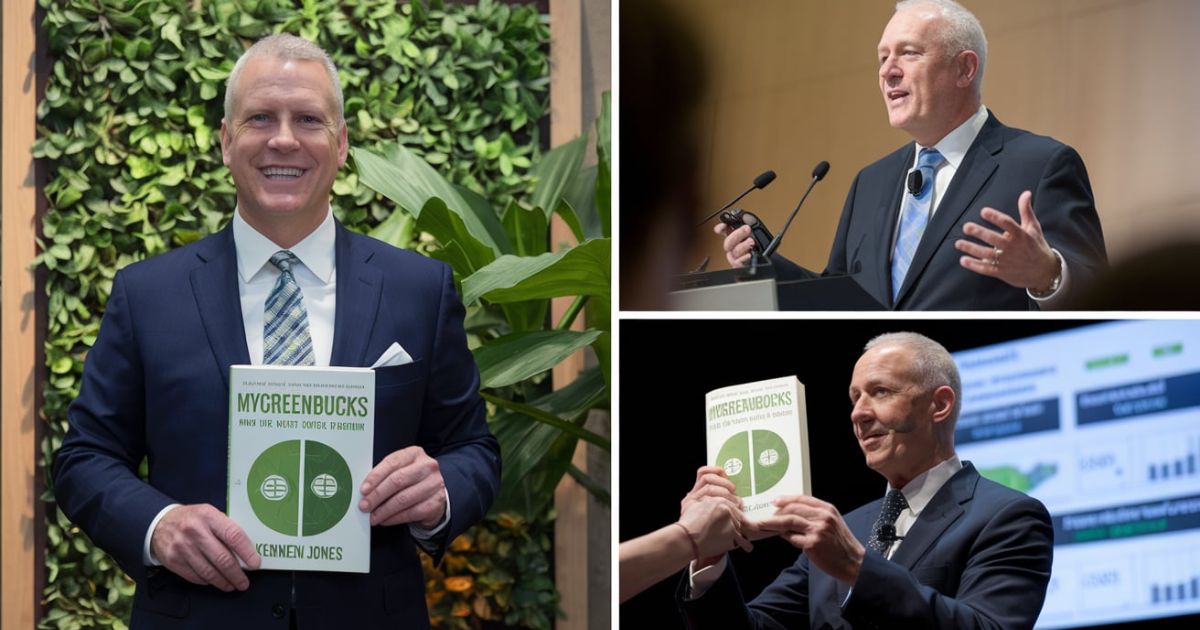

In today’s fast-paced world, achieving financial stability and growth is a top priority for many. MyGreenBucks Kenneth Jones has emerged as a trusted name in the realm of personal finance, offering actionable wealth-building strategies and insights to help individuals take control of their financial future.

Whether you’re looking to build wealth, create passive income opportunities, or simply manage your money better, this guide dives deep into the philosophy, strategies, and tools offered by MyGreenBucks Kenneth Jones.

Understanding the Philosophy Behind MyGreenBucks Kenneth Jones

At the core of MyGreenBucks Kenneth Jones is the belief that financial success is not a matter of luck but a result of consistent effort, smart decision-making, and leveraging opportunities. The platform emphasizes financial literacy as the foundation for building wealth. By understanding the principles of saving, investing, and growing money, individuals can make informed decisions that lead to long-term financial growth.

Key Principles:

- Consistency: Small, regular efforts compound over time.

- Education: Continuous learning about financial markets and tools.

- Risk Management: Diversification and planning for uncertainties.

“Financial freedom is not about being rich; it’s about having control over your money and your life.” – Kenneth Jones

Key Strategies for Wealth Accumulation

Building wealth requires a structured approach. MyGreenBucks Kenneth Jones provides a roadmap that includes budgeting strategies, investing, and creating multiple income streams. Let’s explore these strategies in detail.

Budgeting and Expense Management

Budgeting is the cornerstone of financial success. Without a clear understanding of your income and expenses, it’s impossible to make progress toward your financial goals. MyGreenBucks Kenneth Jones emphasizes the importance of tracking every dollar and creating a budget that aligns with your priorities.

Steps to Effective Budgeting:

- Track Your Spending: Use apps like Mint or YNAB to monitor where your money goes.

- Categorize Expenses: Divide expenses into fixed (rent, utilities) and variable (entertainment, dining out).

- Set Financial Goals: Whether it’s saving for a house or paying off debt, having clear goals keeps you motivated.

- Adjust and Optimize: Regularly review your budget and cut unnecessary expenses.

Example Budget Breakdown:

| Category | Percentage of Income |

| Housing | 30% |

| Transportation | 15% |

| Food | 10% |

| Savings | 20% |

| Entertainment | 5% |

| Miscellaneous | 20% |

Investing for Long-Term Growth

Investing is one of the most effective ways to grow your wealth over time. MyGreenBucks Kenneth Jones advocates for a diversified investment portfolio to minimize risk and maximize returns.

Investment Options:

- Stocks: Ownership in companies with potential for high returns.

- Bonds: Lower-risk investments that provide steady income.

- Real Estate: Tangible assets that appreciate over time.

- Mutual Funds/ETFs: Diversified portfolios managed by professionals.

Why Diversification Matters:

Diversification spreads your investments across different asset classes, reducing the impact of a single underperforming investment. For example, during a stock market downturn, real estate or bonds may perform better, balancing your portfolio.

Compound Growth Example:

| Year | Initial Investment | Annual Return | Total Value |

| 1 | $10,000 | 7% | $10,700 |

| 5 | $10,000 | 7% | $14,025 |

| 10 | $10,000 | 7% | $19,671 |

Creating Multiple Income Streams

Relying on a single source of income is risky. MyGreenBucks Kenneth Jones encourages individuals to explore multiple income streams to build financial resilience.

Popular Income Streams:

- Side Businesses: Freelancing, consulting, or selling products online.

- Dividend-Paying Stocks: Earn passive income through regular dividend payouts.

- Rental Properties: Generate steady cash flow from real estate investments.

- Digital Products: Create and sell e-books, courses, or software.

Example:

- A freelance graphic designer earns $2,000/month from clients.

- They invest in dividend-paying stocks, earning $200/month.

- They rent out a spare room, adding $800/month.

- Total monthly income: $3,000.

The Role of Passive Income in Financial Stability

Passive income is a game-changer for achieving financial independence. MyGreenBucks Kenneth Jones highlights several strategies to earn money with minimal ongoing effort.

Top Passive Income Ideas:

- Rental Income: Earn monthly rent from properties.

- Dividend Investments: Receive regular payouts from stocks.

- Affiliate Marketing: Earn commissions by promoting products.

- Automated Business Models: Set up systems that run with little oversight.

Benefits of Passive Income:

- Reduces reliance on active work.

- Provides financial security during emergencies.

- Frees up time for personal pursuits.

Overcoming Financial Challenges with MyGreenBucks Kenneth Jones

Financial success is not without obstacles. Economic downturns, unexpected expenses, and market volatility can derail your plans. MyGreenBucks Kenneth Jones provides tools and strategies to navigate these challenges.

Key Strategies:

- Emergency Funds: Save 3-6 months’ worth of living expenses.

- Diversified Investments: Spread risk across different asset classes.

- Insurance: Protect against unforeseen events (health, life, property).

Example Emergency Fund Calculation:

| Monthly Expenses | Emergency Fund (3 Months) | Emergency Fund (6 Months) |

| $3,000 | $9,000 | $18,000 |

The Importance of Financial Education

Financial literacy is the foundation of sound decision-making. MyGreenBucks Kenneth Jones stresses the importance of continuous learning to stay ahead in the ever-changing financial landscape.

Key Concepts to Master:

- Inflation: Understand how it erodes purchasing power.

- Interest Rates: Learn how they affect loans and investments.

- Investment Risks: Balance risk and reward in your portfolio.

Resources for Financial Education:

- Books: The Intelligent Investor by Benjamin Graham.

- Podcasts: The Dave Ramsey Show.

- Online Courses: Coursera’s Personal Finance Specialization.

Conclusion

Achieving long-term financial growth is a journey that requires the right mindset, tools, and strategies. MyGreenBucks Kenneth Jones provides a comprehensive framework to help individuals build wealth, create passive income opportunities, and overcome financial challenges. By adopting these principles and staying committed to your goals, you can take control of your financial future and achieve lasting success.

FAQs

What is MyGreenBucks Kenneth Jones?

MyGreenBucks Kenneth Jones is a platform dedicated to providing financial education and wealth-building strategies, including budgeting, investing, and passive income.

How can I start investing with MyGreenBucks Kenneth Jones?

Begin by educating yourself on investment options, diversifying your portfolio, and starting with low-risk investments like index funds or ETFs.

What are the best passive income strategies?

Popular strategies include rental properties, dividend-paying stocks, affiliate marketing, and creating digital products.

How much should I save for an emergency fund?

Aim to save 3-6 months’ worth of living expenses to cover unexpected financial challenges.

Why is financial education important?

Financial education empowers you to make informed decisions, avoid common pitfalls, and achieve long-term financial stability.